Managed Care

Managed Care

| Main Characteristics of Managed Care |

|

MCOs manage financing, insurance, delivery, and payment for providing health care:

|

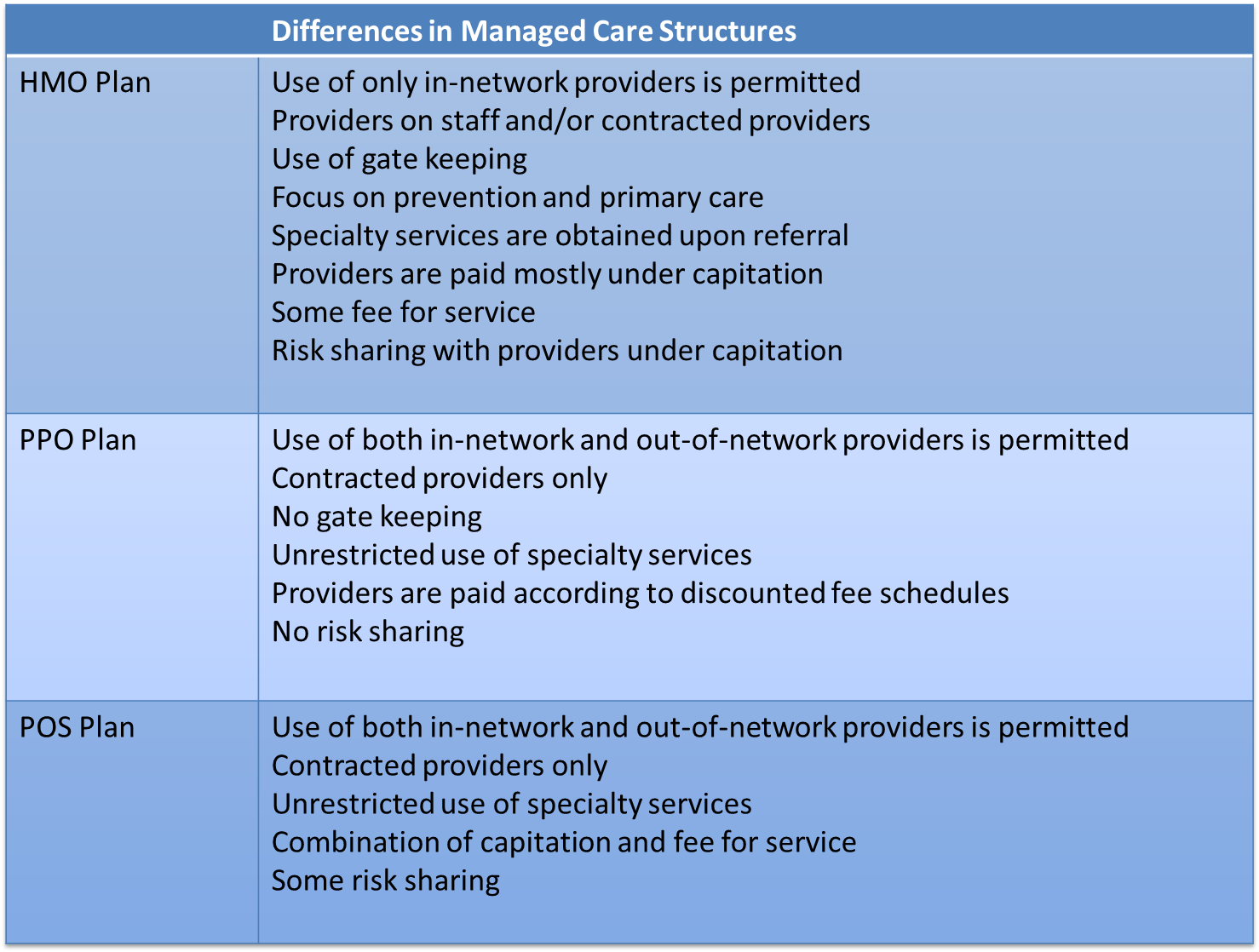

See the table below for descriptions of the three types of manages care plans: Health Maintenance Organization (HMOs), Preferred Provider Plans (PPOs) and Point of Service plans (POS).

Main Differences in Managed Care Structures

- Choice of Providers

- Delivery of Services

- Payment and Risk Sharing Source: Exhibit 9.2, p. 223 from Shi & Singh (2013)

For more on managed care and the differences between HMOs, PPOs, and POS plans watch the Humana video below and read Bodenheimer & Grumbach (2005) Chapter 6 and Chapter 4 (pg. 32-33).

PPOs versus HMOs

The distinction between HMO and PPO is important. PPOs offer more consumer choice and control. There is generally a price for this choice, and that comes in the form of an increased premium. If you are not completely clear on the difference between HMOs and PPOs I recommend watching the video below.

|

PPOs versus HMOs Source: Humana http://www.humana.com/resources/videos/healthcare_education/ppos_hmos.aspx

|

Source: developed by Mary Palaima, PT, MBA, EdD, Clinical Assoc. Professor at Sargent College of Health and Rehabilitative Sciences