:

:Raising Money & Paying Caregivers

There are four categories of health insurance in the United States :

:

The introductory video below, from Humana Healthcare, provide a quick overview of how health insurance works in the United States.

After successfully completing this unit, the student will be able to:

;

;

Workers compensation was one of the first social insurance programs adopted broadly throughout the United States. Under workers compensation, employers are required to make provisions such that workers who are injured in accidents arising out of or in the course of employment receive medical treatment and receive payments ranging up to roughly two-thirds of their wages to replace lost income. Workers compensation laws were originally adopted by most states between 1911-20, and the programs continue to be administered by state governments today (Economic History Services, EH.net). Workers compensation served as a trial balloon for government-sponsored compulsory health insurance before the US moved toward a private (voluntary) system of health insurance. Legislative efforts in 16 states between 1916-18 were unsuccessful in compelling employers to provide health insurance to their workers.

Modern health insurance actually began in the form of hospital insurance during the Great Depression when the high cost of hospitalization threatened the economic well-being of both individuals and hospitals. The American Hospital Association supported hospital insurance, and helped organize hospital plans into the Blue Cross network while the California Medical Association started the Blue Shield plan to pay for physicians outpatient services. The two entities (Blue Cross and Blue Shield) later merged into the program we know today (from Shi & Singh, 2013).

Private health insurance (formerly called voluntary health insurance) began to evolve and expand in the United States in the 1920s. and later led to congressional discussions and reform to meet the specific needs of older adults, the underserved, and those living in poverty, eventually leading to the creation of Medicare and Medicaid programs that would receive public funding.

Health insurance became employer-based during the World War II era when, due to wage freezes, health insurance was used to compensate for the loss of salary increases. In addition, Congress made health insurance benefits nontaxable, and the Supreme Court ruled that benefits, including health insurance, were a legitimate component of union-management negotiations (Shi & Singh, 2013, p. 66.) Until recently, approximately 60 percent of Americans received their health insurance from their employers.

The video below from Humana provides a brief summary of the evolution of US Healthcare starting with the 1940s.

US Healthcare: A Short History

Before publicly financed health insurance was available, government provision of healthcare services to the poor took place at specific care sites, including municipal hospitals and state mental hospitals.

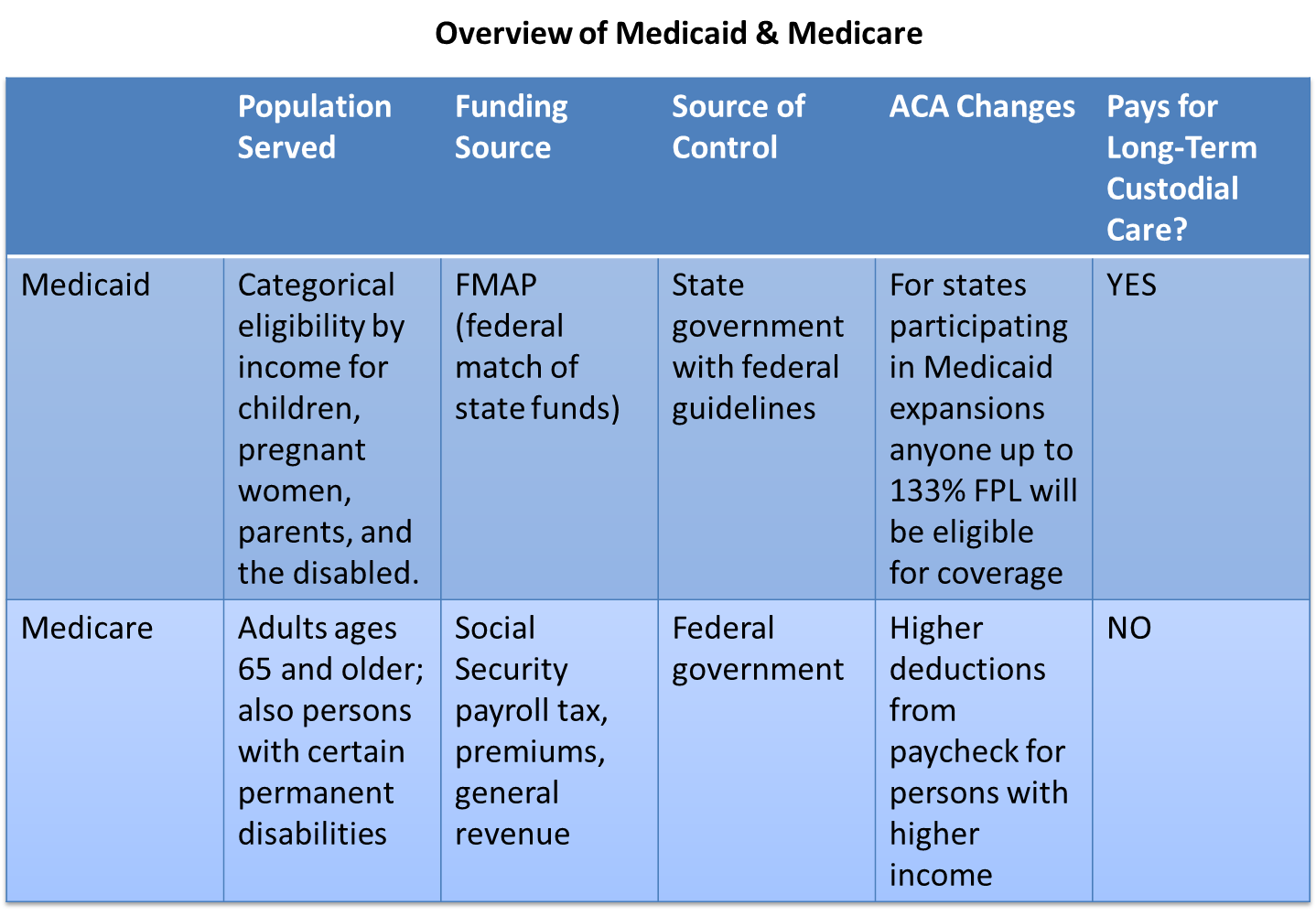

Both of these programs were created in 1965 as part of Lyndon Johnson's Great Society initiatives. Medicare and Medicaid are very different programs in terms of population serviced, funding source, funded services, and management. Medicare is a federal program, designed to provide coverage to the elderly and permanently disabled. Medicaid is a jointly funded program of the federal and state governments, and funding varies greatly among states. There is a saying that if you have seen one state Medicaid program, you have seen one state Medicaid program.

NOTE: A separate online module describes the Affordable Care Act in greater detail.

Through these historical events the various forms of insurance coverage for health care can be summarized by the graphic below on the left. The pie chart shows the percentage of the US population covered by each type..

In contrast to Europe, national health care failed to get an early footing in the United States due to a number of factors.

|

EPO, PPO, HMO: The Alphabet Soup That Tells You How Your Health Plan Works

Health care lingo can be an alphabet soup of terminology. You can review a list of health care-related acronyms by going back to the Home Page of the course and selecting the "Guide to Acronyms". There is one set of terms that it is important to be familiar with so you know how your plan works - your health plan's type. Knowing the mechanics of your plan will help you navigate the complexities of health plan benefits and avoid unexpected and costly out-of-pocket charges.

Different types of insurance plans are offered on the exchanges, from employers, from Medicare (through Medicare Advantage) and through Medicaid. The Commonwealth of Massachusetts has a helpful explanation of different plan types. The information below is adapted from their site. |

|---|

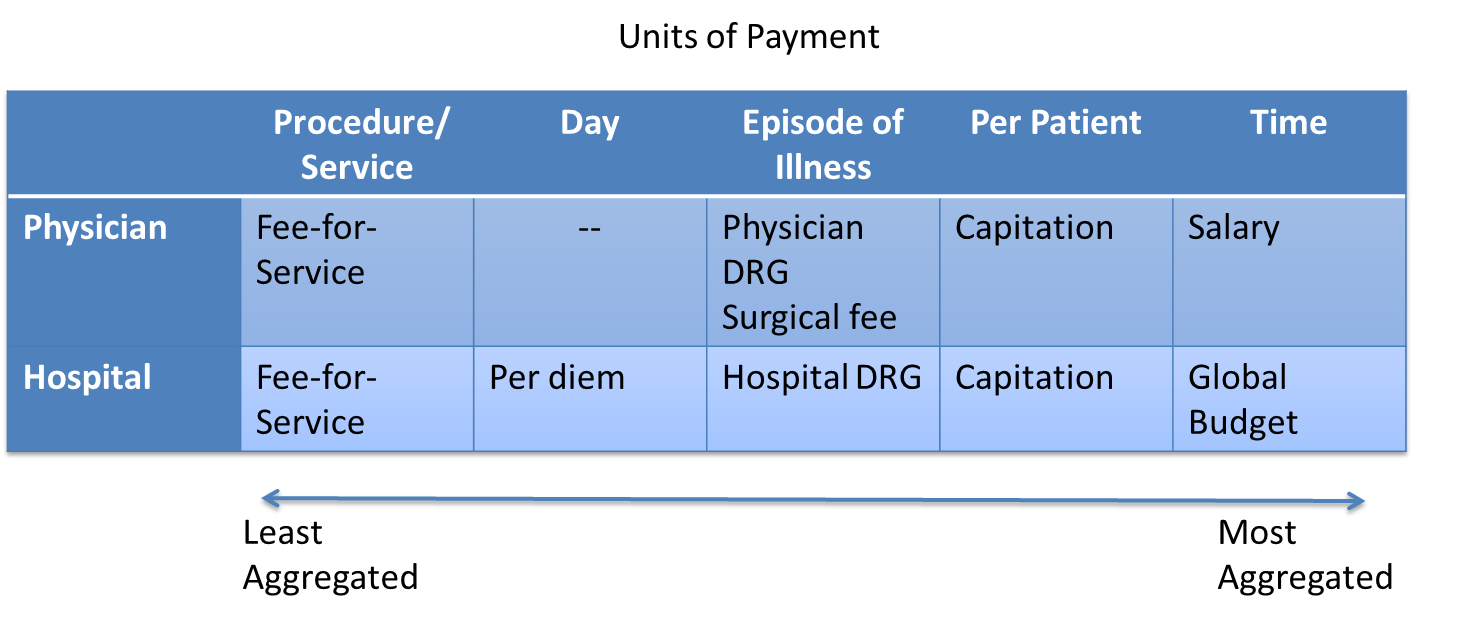

An indemnity plan simplly reimburses for services as they occur. The reimbursement goes to the provider or the insured. Indemnity plans were popular until the early 1990s. Today they are infrequently offered in the private markets. Medicare parts A and B are conventional plans (we refer to these as fee for service), and some Medicaid plans.

If you are in an HMO, you must use network providers - doctors, hospitals and other health care providers - that participate in the plan. The only exception is for emergency care. An HMO requires the selection of a Primary Care Physician (PCP) to manage your care. Referrals are usually needed from your PCP to see a specialist, who must also be in the network.

EPO (Exclusive Provider Organization): Similar to an HMO, with an EPO you must use network providers - doctors, hospitals and other health care providers - that participate in the plan. The only exception is for emergency care. Unlike an HMO, you do not need to select a Primary Care Physician, nor do you need to contact your PCP for referrals to specialists.

PPO (Preferred Provider Organization): With a PPO, you receive more comprehensive benefits by using network providers - doctors, hospitals and other health care providers - that participate in the plan. You have the option of using non-network providers, but with a lower level of benefits and higher out-of-pocket costs. Because PPOs usually have broader networks, they are generally more expensive - have higher premiums - than HMOs and EPOs. With a PPO, you do not need to select a Primary Care Physician.

POS (Point of Service Plan): A hybrid plan with features of an HMO plus indemnity coverage. Care within the network is similar to HMO arrangement previously described. The difference between PPO and POS is the way in which providers are reimbursed.

It is important for consumers to become knowledgeable about the terms of their insurance plans or risk unexpected out-of-pocket costs. In some plans (especially HMOs) out of network visits are not covered, except in extreme circumstances, and even then they require pre-approval (for a service that is medicallynecessary and not provided by any of the HMOs providers). The exception to network rules is in medical emergencies, but even then there may be higher cost sharing if the emergency department is out of network.

The graphics below summarize the array of health care coverage in the United States. Subsequent sections will describe these various types of coverage in more detail.

|

|

|

Medicare, the federal health insurance program that currently covers 50 million Americans who are:

Medicare, the federal health insurance program that currently covers 50 million Americans who are:

Medicare helps to pay for hospital and physician visits, prescription drugs, and other acute and post- acute services. In 2012, spending on Medicare accounted for 15% of the federal budget. Medicare also plays a major role in the health care system, accounting for 21% of total national health care spending in 2012, 28% of spending on hospital care, and 24% of spending on physician services.

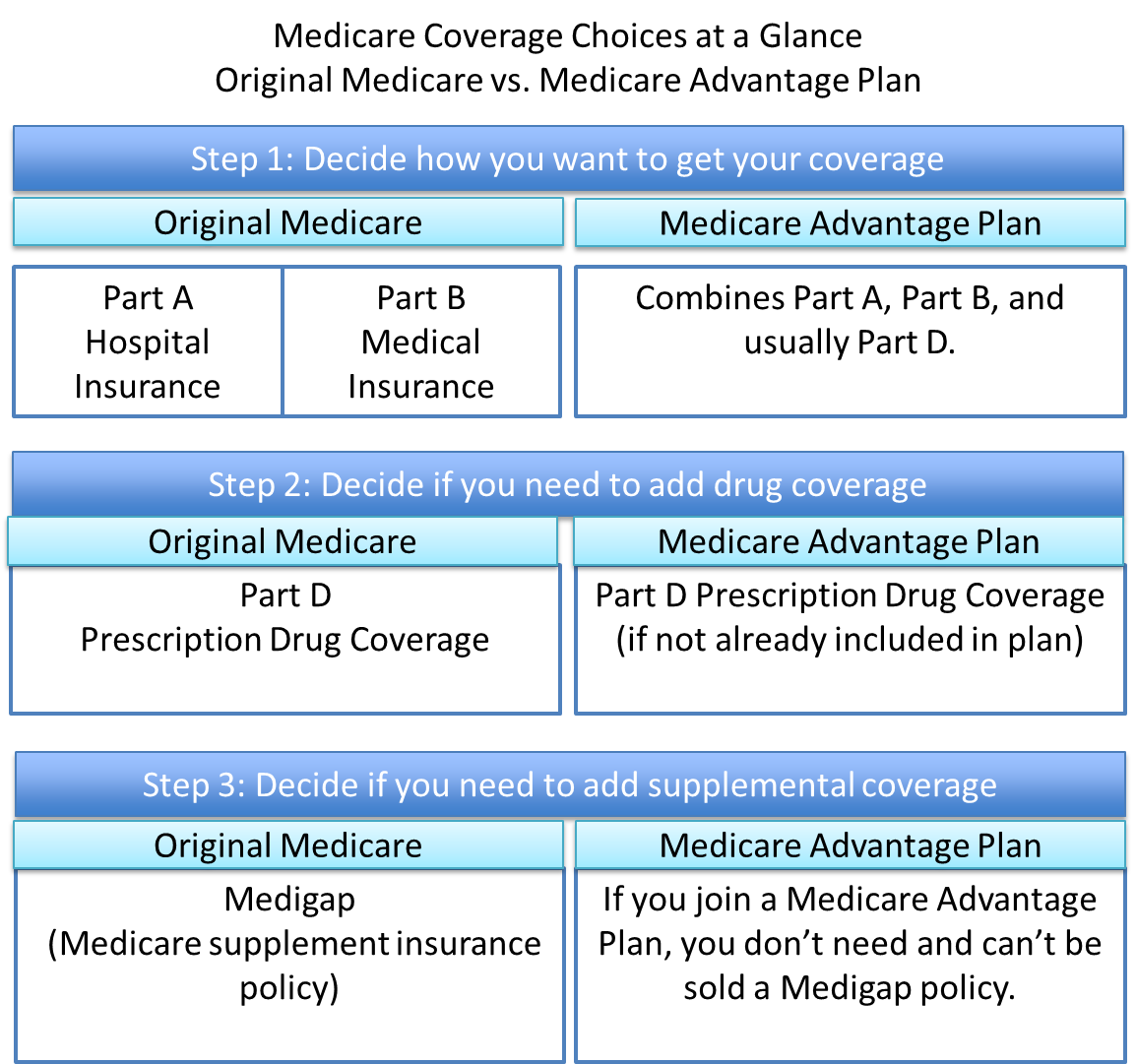

The Medicare program is comprised of four parts - Part A, Part B, Part C (also known as Medicare Advantage), and Part D. Together, these four parts provide coverage for basic medical services and prescription drugs. A Medigap (Medicare Supplement Insurance) policy to help pay some of the health care cost "gaps" (like copayments, coinsurances, and deductibles) can be purchased privately.

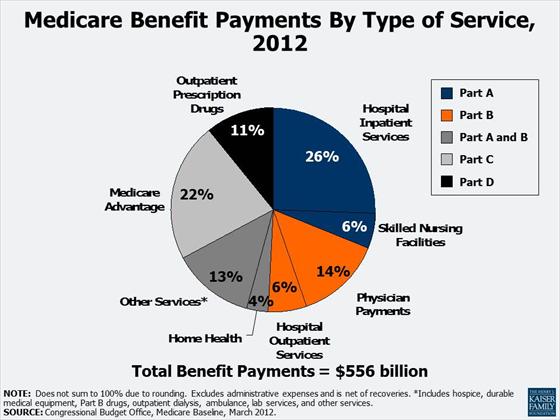

Medicare benefit payments are expected to total $556 billion in 2012; roughly two-thirds is for Part A (Hospital Insurance, or HI), and Part B (Supplementary Medical Insurance, or SMI) services. More than 20% is for Part C, Medicare Advantage private health plans covering all Part A and B benefits, and just over 10% is for the Part D drug benefit.

Medicare spending per beneficiary is highly skewed, with the top 10% of beneficiaries in traditional Medicare, accounting for 57% of total Medicare spending in 2009 - on a per capita basis, more than five times greater than the average across all beneficiaries in traditional Medicare ($55,763 vs. $9,702).

Source: www.medicare.gov/navigation/medicare-basics/medicare-benefits/medicare-benefits-overview.aspx

Coverage: Part A covers inpatient hospital care, some skilled nursing facility stays, home health care, and hospice care. If you or your spouse have worked for at least 40 quarters (10 years) and paid Medicare payroll taxes, you qualify for Part A coverage, and you don't have to pay a monthly premium for it. This is referred to as "premium-free Part A."

Funding: Part A is paid for by a portion of Social Security tax. Most people pay no premium because the individual or his/her spouse paid Medicare taxes while working in the US

A Medigap (Medicare Supplement Insurance) policy to help pay some of the health care cost gaps (like copayments, coinsurances, and deductibles) can be purchased privately.

Coverage: Part B, or the Supplementary Medical Insurance (SMI) program, helps pay for physician services, outpatient hospital care, and some home health visits not covered under Part A. It also covers laboratory and diagnostic tests, such as X-rays and blood work; durable medical equipment, such as wheelchairs and walkers; certain preventive services and screening tests, such as mammograms and prostate cancer screenings; outpatient physical, speech and occupational therapy; outpatient mental health care; and ambulance services.

Funding: People who elect Part B must pay a monthly premium. Most people who pay a Part B premium have it automatically deducted from their Social Security check. If your income is limited, you may qualify for programs that will pay the Part B premium on your behalf. The standard monthly Part B premium in 2012 is $99.90. Some people on Medicare with higher annual incomes (more than $85,000/individual; $170,000/couple) pay a higher monthly Part B premium, ranging from $139.90 to $319.70 per month in 2012, depending on their income.

Part B also has an annual deductible of $140 in 2012 - i.e., you must pay $140 out-of-pocket before Medicare begins paying. After you meet the deductible, most Part B services require a 20 percent coinsurance; this means you pay 20 percent of the cost of the service. If a doctor is a "participating provider" then the most he or she can ever charge you is 20 percent of the Medicare-approved amount for a service. This is called "accepting assignment."

Coverage: Part C allows beneficiaries to enroll in a private insurance plan, called a Medicare Advantage plan. Medicare Advantage plans are managed care plans, such as Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs). Medicare Advantage plans must cover all Part A and B services and usually include Part D (prescription drug coverage) benefits in the same plan. These plans sometimes cover additional benefits not covered by traditional Medicare, such as routine vision and dental care. All plans have an annual limit on your out-of-pocket costs for Part A and B services, and once you reach that limit, you pay nothing for covered services for the rest of the calendar year. The out-of-pocket limit can be high but may help protect you if you need a lot of health care or need expensive treatment. Out-of-pocket costs include deductibles, copayments and coinsurance.

Although Medicare Advantage plans must cover Part A and B services, they can have different rules, costs and restrictions. Some plans have higher cost-sharing requirements than Original Medicare for some services, and most plans apply restrictions that limit your choices of doctors or hospitals.

Funding: Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care). These rules can change each year.

Coverage: In 2006, Medicare began offering outpatient prescription drug coverage under Medicare Part D. Medicare drug coverage is optional for most people with Medicare and is offered only through Medicare private plans. If you have Original Medicare and want Part D drug coverage, you can get a stand-alone prescription drug plan (PDP). People who want a Medicare Advantage plan and drug coverage must generally get it through one plan called a Medicare Advantage prescription drug plan (MA-PD).

Funding: There is a monthly premium for Part D. Premiums vary widely among plans, as do the drugs that are covered and the amounts charged for prescriptions. The standard Part D benefit has a deductible, which in 2012 can be no more than $320, and 25 percent coinsurance on covered drugs up to an initial coverage limit. This is followed by a coverage gap, during which enrollees are responsible for a larger share of their total drug costs than during the initial coverage period, until they reach the catastrophic coverage limit. Thereafter, enrollees have low costs for their drugs.

For more complete information about Medicare, see the following publication "Talking About Medicare - Your Guide to Understanding the Program" by the Kaiser Family Foundation (updated 2012)"

|

|

|

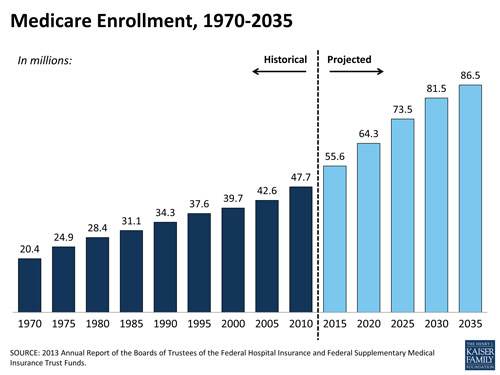

Medicare takes up a significant chunk of federal spending (remember states do not pay for Medicare). There is increasing concern because as the US population ages and life expectancy increases enrollment in Medicare will grow. See below.

Medicare is the federal health insurance program for 54 million people ages 65 and over and people with permanent disabilities. In 2013, spending on Medicare was $492 billion and accounted for 14% of the federal budget. Medicare also plays a major role in the health care system, accounting for 20% of total national health spending in 2012, 27% of spending on hospital care, and 23% of spending on physician services

Additional Resources:

There are two main ways you get Medicare coverage: Original Medicare or a Medicare Advantage Plan. These steps help determine which coverage to get.

Utilize this PDF file below on Medicare Coverage Basics to analyze and calculate Medicare coverage in the situations listed below. Generate a list of costs for which the beneficiary is responsible (out-of-pocket costs). Assume both patients have Medicare A and B.

Source: developed by Mary Palaima, PT, MBA, EdD, Clinical Assoc. Professor at Sargent College of Health and Rehabilitative Sciences

|

Patient #1: A 68 y.o. female who had a stroke with multiple medical complications. She spent 65 days in the hospital, followed by 25 days in a local SNF (Skilled Nursing Facility), and then received home health services (nursing, PT, OT, SLP) for 21 days. Answer |

Patient #2: This woman had a stroke with medical complications. She spends 14 days in the hospital followed by 40 days in a local SNF, and then receives 50 visits of PT, OT, SLP as an outpatient. Assume the charge for each therapy visit is $100.00. Answer |

Medicare Quiz

Take this short quiz to see how much you remember!

If you would like more information about Medicare check these three sites:

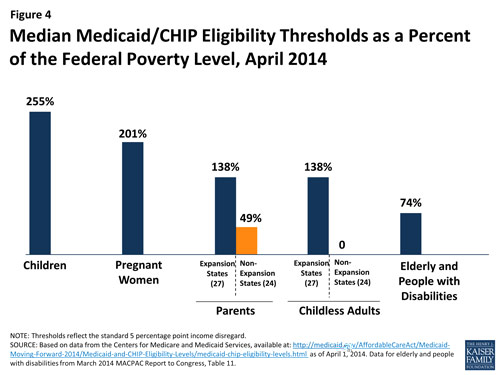

Before January 2014 state Medicaid programs were required to cover poor pregnant women and children, and the FPL cutoffs varied by group. States had the option of providing increased coverage within these groups, and to expand coverage to other people. As previously explained Medicaid expansion will cover all persons up to 133% of the FPL in states choosing to expand. If states do not expand, coverage will vary by FPL within a group. Pregnant women, children, the elderly and the disabled have minimum coverage thresholds. Many states have minimal or no coverage for adults, especially for adults without children.

Medicaid is jointly funded by the US Federal Government and the individual States. The federal government pays states for a specified percentage of program expenditures (the FMAP). More information is available on the Financing and Reimbursement web page at Medicaid.gov.

The Children's Health Insurance Program (CHIP) provides health coverage to nearly 8 million children in families with incomes too high to qualify for Medicaid, who can't afford private coverage. Signed into law in 1997, CHIP provides federal matching funds to states to provide this coverage. See additional information on Cost Sharing.

|

If you would like more information about Medicaid, check these three sites:

|

|

Comparison of Medicare and Medicaid |

|

|

Medicare |

Medicaid |

|

|

Dual eligible refers to patients with both Medicare and Medicaid. The care of dual eligibles is often expensive, fragmented, and of varying quality. Innovative models of care for duals (often consider duals < 65 years separately from elderly duals) are needed to provide efficient and effective care for these vulnerable populations.

|

Dual Eligibles |

Infographic: Medicaid Spending and Enrollment: Who Is Covered and What Does the Program Spend on Their Care

Source: http://kff.org/interactive/infographic-medicaid-spending-enrollment/. The Infographic in the window above is a web page with links that you can explore on your own. You can scroll through the web page using the scroll bar on the right side of the frame.

Medicaid 101: What You Need to Know

Source: http://www.kff.org/medicaid/ahr030113.cfm

Medicaidand Medicare are paid for by tax revenues; private insurance is paid for by individuals and employers (with the ACA, individuals will be eligible to receive public funds as subsidy for the purchase of private insurance on the exchanges). Public insurance covers an individual only. Private insurance is often available for individual or family coverage. Most private insurance is employer sponsored and is subsidized by tax exemption. Contirbutions by the employer and the employee are pre-tax contributions, meaning that the premium is not taxed. Howerver, this benefit is tied to employment, and the benefit does not continue once employment with a given company ends. ESI is more likely to be offered to specific types of employees: full-time, higher income, larger businesses, or unionized employees.

For more information about ESI and the growth of premiums and employee contributions, check out Kaiser's employer health benefits survey: http://facts.kff.org/results.aspx?view=slides&detail=53

One way in which employers are trying to control health care costs is to institute employee well-ness programs. Do you think this is a reward for maintaining health or financially penalizing persons who are older or have health problems? See Goldberg, C.: Can My Company's Wellness Program Really Ask Me To Do That? CommonHealth Blog. September 28, 2012.

The issue of tax subsidies for ESI is complex.The details are beyond the scope of this course, but if you have an interest in policy/finance you may want to read Tax Subsidies for Health Insurance:

|

|

|

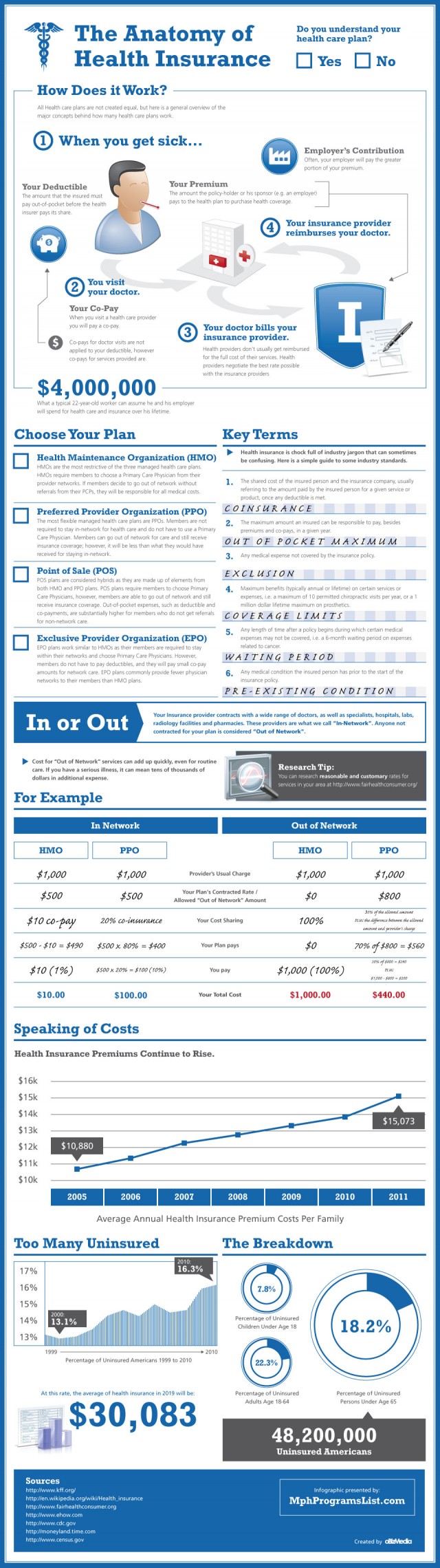

Cost sharing is quite literally the insured individual sharing the cost of care with the insurance company. The employee has risk. In other words, if he/she uses care there will be a financial consequence. In theory this will make the inured individuals more likely to make health care decisions that take cost into account. In other words if the person has to pay a part of the care then he or she will chose less expensive care, avoid unnecessary care, and seek care only when needed. The economic theory of moral hazard maintains that insurance changes behavior. If a person is insulated against the cost then he or she will use more services.

Premiums are not the same type as cost sharing because they do not vary with utilization, but your book does categorize them as such. The three types of cost sharing are co-pays, co-insurance and deductibles. The arrangements vary by plan. See the infographic below for more information.

Humana Video on Deductibles and Copayments

http://www.humana.com/resources/videos/healthcare_education/deductibles_copays.aspx

For a synthesis of managed care and cost sharing check out The Anatomy of Health Insurance Infographic.

Source: http://dailyinfographic.com/overview-of-health-insurance-infographic

| Main Characteristics of Managed Care |

|

MCOs manage financing, insurance, delivery, and payment for providing health care:

|

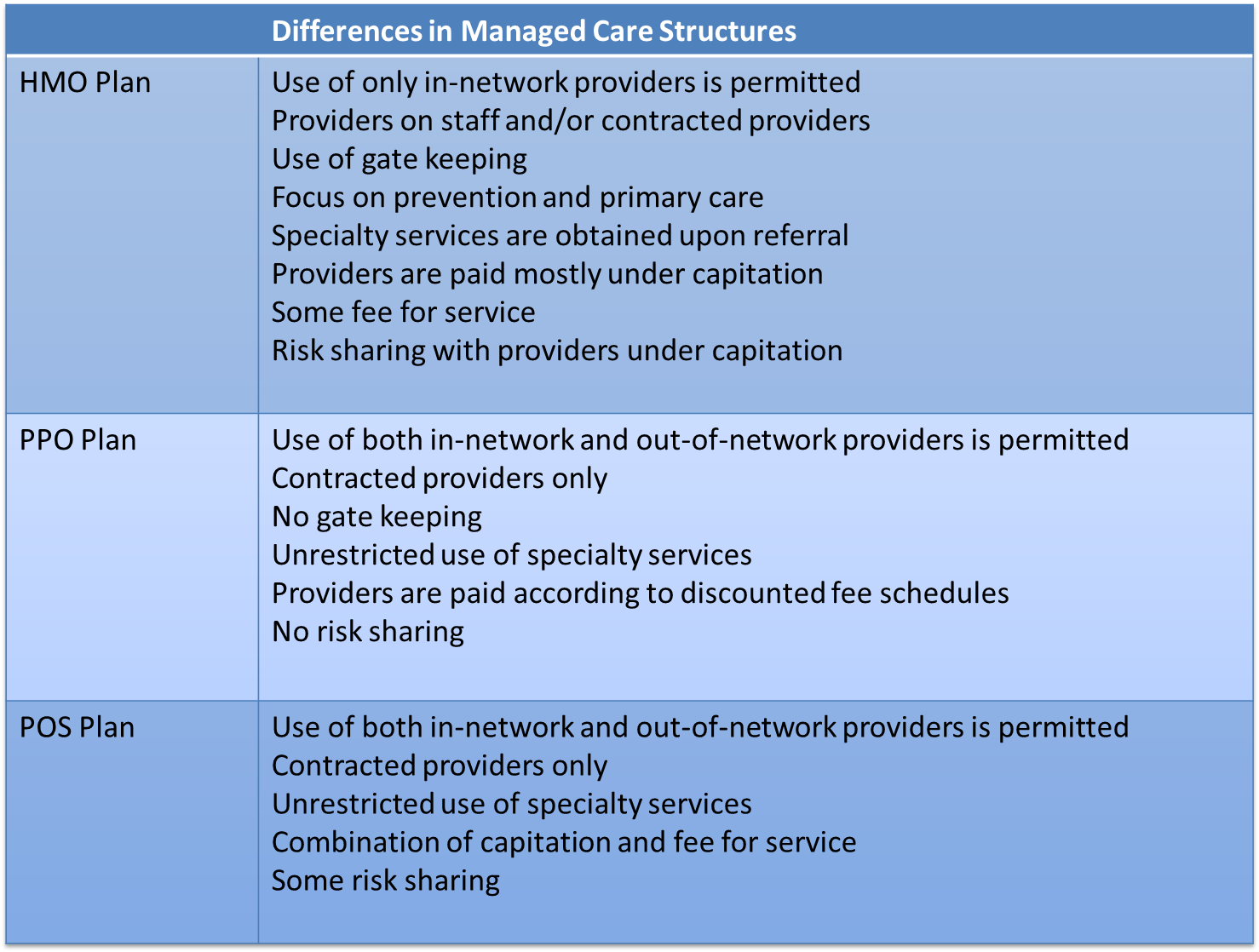

See the table below for descriptions of the three types of manages care plans: Health Maintenance Organization (HMOs), Preferred Provider Plans (PPOs) and Point of Service plans (POS).

For more on managed care and the differences between HMOs, PPOs, and POS plans watch the Humana video below and read Bodenheimer & Grumbach (2005) Chapter 6 and Chapter 4 (pg. 32-33).

The distinction between HMO and PPO is important. PPOs offer more consumer choice and control. There is generally a price for this choice, and that comes in the form of an increased premium. If you are not completely clear on the difference between HMOs and PPOs I recommend watching the video below.

|

PPOs versus HMOs Source: Humana http://www.humana.com/resources/videos/healthcare_education/ppos_hmos.aspx

|

Source: developed by Mary Palaima, PT, MBA, EdD, Clinical Assoc. Professor at Sargent College of Health and Rehabilitative Sciences

Community Rating

Experience Rating

The main difference between community rating and experience rating is geography and inclusion.

The main difference between community rating and experience rating is geography and inclusion.

Note: The ACA returns to community rating practices in the health exchanges

Medicare provides health coverage to approximately 50 million beneficiaries ages 65 and older and younger people with permanent disabilities. Medicare remains a hot topic in Washington and around the country as political leaders and other policy makers weigh potential changes to the program. How much do you know about Medicare, the people it serves, the benefits it covers, and its financial status?

Test Your Knowledge (Source: Kaiser Family Foundation (2013). Medicare Quiz.)

Medicaid, the nation's publicly funded health coverage program for low-income Americans, is a primary source of coverage, access, and health care financing, as well as a key component of the expansion of coverage in the Affordable Care Act. How much do you know about Medicaid, the role it plays in the lives of many Americans, how program dollars are spent and how Medicaid eligibility will change under health reform? (Source: Kaiser Family Foundation (2013). Medicaid Quiz)