Historical Background

Workers compensation was one of the first social insurance programs adopted broadly throughout the United States. Under workers compensation, employers are required to make provisions such that workers who are injured in accidents arising out of or in the course of employment receive medical treatment and receive payments ranging up to roughly two-thirds of their wages to replace lost income. Workers compensation laws were originally adopted by most states between 1911-20, and the programs continue to be administered by state governments today (Economic History Services, EH.net). Workers compensation served as a trial balloon for government-sponsored compulsory health insurance before the US moved toward a private (voluntary) system of health insurance. Legislative efforts in 16 states between 1916-18 were unsuccessful in compelling employers to provide health insurance to their workers.

Modern health insurance actually began in the form of hospital insurance during the Great Depression when the high cost of hospitalization threatened the economic well-being of both individuals and hospitals. The American Hospital Association supported hospital insurance, and helped organize hospital plans into the Blue Cross network while the California Medical Association started the Blue Shield plan to pay for physicians outpatient services. The two entities (Blue Cross and Blue Shield) later merged into the program we know today (from Shi & Singh, 2013).

Private health insurance (formerly called voluntary health insurance) began to evolve and expand in the United States in the 1920s. and later led to congressional discussions and reform to meet the specific needs of older adults, the underserved, and those living in poverty, eventually leading to the creation of Medicare and Medicaid programs that would receive public funding.

- 1929 - Justin Kimball starts a hospital insurance plan for teachers at Baylor University. This later became the model for Blue Cross Plan.

- 1939 - The California Medical Association starts the first Blue Shield plan, which was designed to pay physicians fees.

- 1974 - Blue Cross and Blue Shield plans began to merge and are now virtually inseparable.

Health insurance became employer-based during the World War II era when, due to wage freezes, health insurance was used to compensate for the loss of salary increases. In addition, Congress made health insurance benefits nontaxable, and the Supreme Court ruled that benefits, including health insurance, were a legitimate component of union-management negotiations (Shi & Singh, 2013, p. 66.) Until recently, approximately 60 percent of Americans received their health insurance from their employers.

The video below from Humana provides a brief summary of the evolution of US Healthcare starting with the 1940s.

US Healthcare: A Short History

Before publicly financed health insurance was available, government provision of healthcare services to the poor took place at specific care sites, including municipal hospitals and state mental hospitals.

- 1965 Medicare and Medicaid are enacted by the US Congress.

Both of these programs were created in 1965 as part of Lyndon Johnson's Great Society initiatives. Medicare and Medicaid are very different programs in terms of population serviced, funding source, funded services, and management. Medicare is a federal program, designed to provide coverage to the elderly and permanently disabled. Medicaid is a jointly funded program of the federal and state governments, and funding varies greatly among states. There is a saying that if you have seen one state Medicaid program, you have seen one state Medicaid program.

- 2010 The Affordable Care Act (ACA) was signed by President Obama in March 2010. The ACA has provisions for Medicaid expansion

may serve to standardize the programs, but it remains unclear how the expansion will play out in the individual states.

may serve to standardize the programs, but it remains unclear how the expansion will play out in the individual states.

NOTE: A separate online module describes the Affordable Care Act in greater detail.

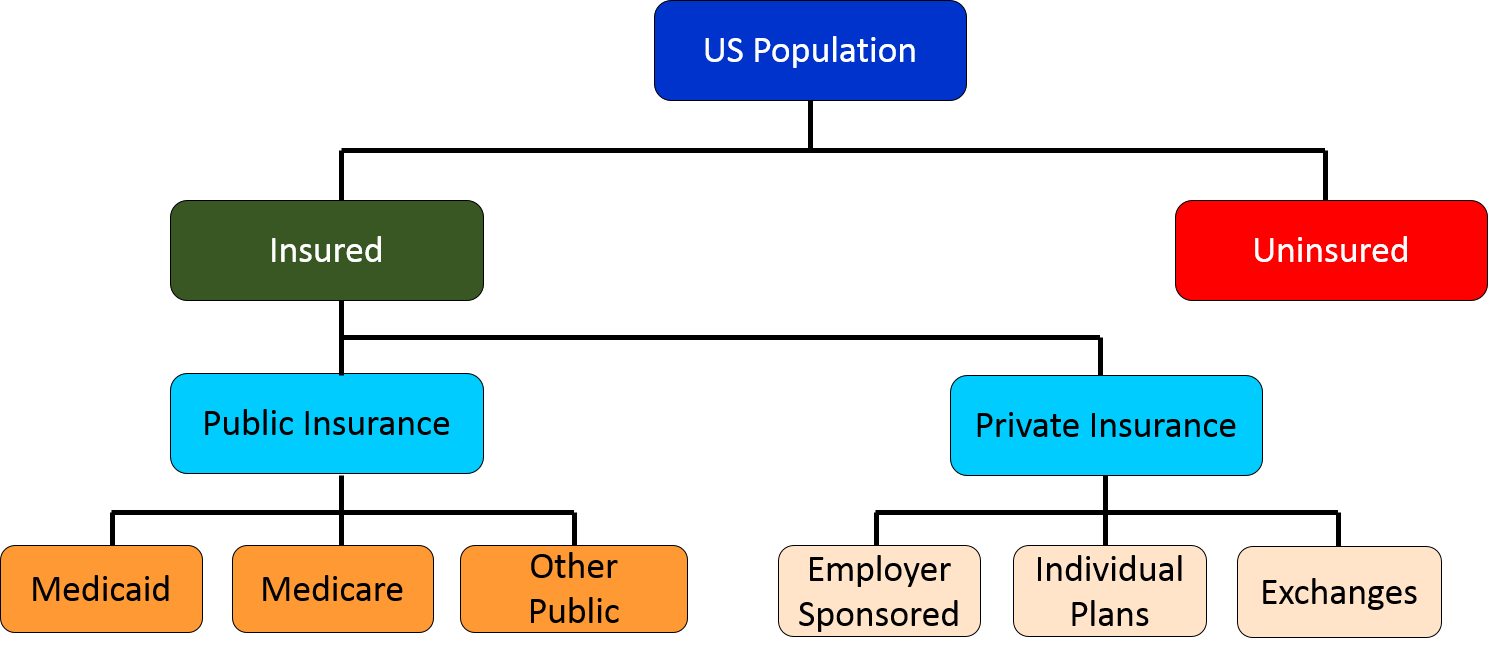

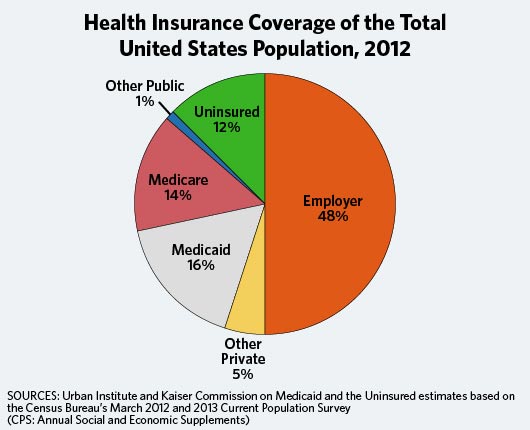

Through these historical events the various forms of insurance coverage for health care can be summarized by the graphic below on the left. The pie chart shows the percentage of the US population covered by each type..

In contrast to Europe, national health care failed to get an early footing in the United States due to a number of factors.

- Labor and political stability in the United States.

- The decentralized American system gave the federal government little direct control over social policy.

- The German social insurance system was denounced during WWI. Since then, the term "socialized medicine" has been used as a synonym for national health care

- The AMA has historically opposed national health care initiatives.

- Middle-class Americans have traditionally espoused beliefs and values that are consistent with capitalism, self-determination, and distrust of big government.

- Many middle-class Americans are averse to the higher taxes that a national health care program would necessitate (Shi & Singh, 2013, p.68) Medicare and Medicaid.

Insurance Plan Types

|

EPO, PPO, HMO: The Alphabet Soup That Tells You How Your Health Plan Works

Health care lingo can be an alphabet soup of terminology. You can review a list of health care-related acronyms by going back to the Home Page of the course and selecting the "Guide to Acronyms". There is one set of terms that it is important to be familiar with so you know how your plan works - your health plan's type. Knowing the mechanics of your plan will help you navigate the complexities of health plan benefits and avoid unexpected and costly out-of-pocket charges.

Different types of insurance plans are offered on the exchanges, from employers, from Medicare (through Medicare Advantage) and through Medicaid. The Commonwealth of Massachusetts has a helpful explanation of different plan types. The information below is adapted from their site. |

|---|

Indemnity or Conventional Plans:

An indemnity plan simplly reimburses for services as they occur. The reimbursement goes to the provider or the insured. Indemnity plans were popular until the early 1990s. Today they are infrequently offered in the private markets. Medicare parts A and B are conventional plans (we refer to these as fee for service), and some Medicaid plans.

HMO (Health Maintenance Organization):

If you are in an HMO, you must use network providers - doctors, hospitals and other health care providers - that participate in the plan. The only exception is for emergency care. An HMO requires the selection of a Primary Care Physician (PCP) to manage your care. Referrals are usually needed from your PCP to see a specialist, who must also be in the network.

Types of HMOs

- Staff model: The HMO owns the facility and pays the providers via salary.

- Group model: The HMO contracts with only one provider group. HMO patients must be seen within that closed group. This group of providers may care for non-HMO patients.

- Network model: Similar to the group model, but the HMO contracts with multiple groups.

EPO (Exclusive Provider Organization): Similar to an HMO, with an EPO you must use network providers - doctors, hospitals and other health care providers - that participate in the plan. The only exception is for emergency care. Unlike an HMO, you do not need to select a Primary Care Physician, nor do you need to contact your PCP for referrals to specialists.

PPO (Preferred Provider Organization): With a PPO, you receive more comprehensive benefits by using network providers - doctors, hospitals and other health care providers - that participate in the plan. You have the option of using non-network providers, but with a lower level of benefits and higher out-of-pocket costs. Because PPOs usually have broader networks, they are generally more expensive - have higher premiums - than HMOs and EPOs. With a PPO, you do not need to select a Primary Care Physician.

POS (Point of Service Plan): A hybrid plan with features of an HMO plus indemnity coverage. Care within the network is similar to HMO arrangement previously described. The difference between PPO and POS is the way in which providers are reimbursed.

It is important for consumers to become knowledgeable about the terms of their insurance plans or risk unexpected out-of-pocket costs. In some plans (especially HMOs) out of network visits are not covered, except in extreme circumstances, and even then they require pre-approval (for a service that is medicallynecessary and not provided by any of the HMOs providers). The exception to network rules is in medical emergencies, but even then there may be higher cost sharing if the emergency department is out of network.

The graphics below summarize the array of health care coverage in the United States. Subsequent sections will describe these various types of coverage in more detail.

|

|

|